Find The Best Pet Insurance In VA

Searching for pet insurance for your dog or cat in Virginia is a great idea regardless of whether you live in Virginia Beach, Norfolk, Richmond or anywhere else in The Old Dominion State.

Among VA’s 8,500,000 residents, it’s estimated that of the roughly 1,900,000 dogs and 1,400,000 cats only about 1 in 50 (about 2%) of those pets are covered today by pet insurance according to the American Pet Health Insurance Association.

How Much Will Pet Insurance Cost You In VA?

Your Virginia specific quote will depend on whether you have dog or cat, their age, breed and other factors – so it’s best to get a free personalized estimate.

Check By City

Article Contents

- Best Pet Insurance Companies

- Average Pet Insurance Costs

- Is Pet Insurance Worth It?

- How Much Are Vet Visits?

- Does My Vet Take Insurance?

- How Does Pet Insurance Work?

- Types Of Pet Insurance Plans

- Insurance Plan Deductibles & Options

- Insurance For Pets With Pre-Existing Condition?

Best Virginia Pet Insurance Options

Regardless of whether you live in Eastern VA near West Virginia, Western VA towards Illinois or Northern Virginia towards Indiana and Ohio, you’ll be able to find some of the best insurance coverage for your cat or dog from these top rated pet insurance providers that will cover you in VA.

| Company | Minimum Age | Claim Payout Time | Costs & Reimbursement |

|---|---|---|---|

| ASPCA | 8 weeks | Average 9 days to pay | |

| Embrace | |||

| FIGO | |||

| Healthy Paws | |||

| Nationwide | |||

| PetPlan | 6 weeks | Average 6 days to pay | |

| Pets Best | 7 weeks | Average7 days to pay | |

| Trupanion |

Research Personalized Virginia Pet Insurance Quotes

What Does Pet Insurance Cost In Virginia (VA)?

How much does pet insurance in VA cost? What will your monthly premiums be? The table below will give you some concise estimates about the price and how much you might pay each month for your premiums based on some pet and age examples. Or you can research and get more specific details for dog insurance or cat insurance specifically.

Annual Virginia Pet Insurance Price Premium Estimates

- Adult Golden Retriever: $504 to $1,692 per year for an 80% reimbursement plan & $500 deductible

- Puppy Golden Retriever: $372 to $1,392 per year for an 80% reimbursement plan & $500 deductible

- Adult Chihuahua: $276 to $1,044 per year for an 80% reimbursement plan & $500 deductible

- Puppy Chihuahua: $216 to $864 per year for an 80% reimbursement plan & $500 deductible

- Adult Domestic Cat: $204 to $588 per year for an 80% reimbursement plan & $500 deductible

- Domestic Kitten: $168 to $504 per year for an 80% reimbursement plan & $500 deductible

Monthly Pet Insurance Costs For VA

| Pet Breed & Age | Virginia Beach, VA | Norfolk, VA | Richmond, VA |

|---|---|---|---|

| Golden Retriever (Adult) | 5 Years | $42 – $81 | $45 – $72 | $45 – $141 |

| Golden Retriever (Puppy) | 6 Months | $31 – $66 | $33 – $59 | $33 – $116 |

| Chihuahua (Adult) | 5 Years | $23 – $50 | $24 – $44 | $24 – $87 |

| Chihuahua (Puppy) | 6 Months | $18 – $41 | $19 – $37 | $19 – $72 |

| Domestic Cat (Adult) | 5 Years | $17 – $30 | $18 – $22 | $18 – $49 |

| Domestic Cat (Kitten) | 6 Months | $14 – $25 | $15 – $19 | $15 – $42 |

Is Pet Insurance Worth It In Virginia?

Pet insurance is like any other insurance. You have it as protection, but hope that you will never need it. Unfortunately 80% of pet owners can’t pay for a $5,000 veterinary bill out of pocket and 40% of Americans can’t afford to cover an unexpected $400 bill on their own.

Unexpected vet bill in Frankfort, Louisville, Lexington, or any city in Virginia can easily be hundreds if not thousands of dollars. So getting pet insurance in VA is a great way to both protect you against the unexpected costs of a pet injury or illness while making sure your pet will get the health care they need.

How Much Are Vet Visits?

An emergency trip to your vet in Virginia will vary widely by the type of care your dog or cat needs, their health history and the type of pet, size or breed. As you can imagine, the more serious the emergency the more expensive the care will be.

Treating a cut on a small dog may be fairly minor in costs like a few hundred dollars, but treating a broken leg on a large dog may easily cost $5,000 or more.

Compare Cost Estimates Of Emergency Vet Visits

When considering how much an unexpected vet visit in VA might cost you, it’s important to remember that vet prices are also influenced by the region you live in. Virginia is an above average cost state to live in with an average of about 4% more expensive than the US as a whole.

| Estimated Vet Procedure Prices In Virginia | Cats | Dog (Small) | Dog (Large) |

|---|---|---|---|

| Exam / Vet Consultation | $104-$156 | $104-$156 | $104-$156 |

| Diganostic Bloodwork Panel | $83-$208 | $83-$208 | $83-$208 |

| Pet X-Ray | $156-$260 | $156-$260 | $156-$260 |

| 1-2 Days Of Pet Hospitalization | $624-$1,560 | $624-$1,560 | $832-$1,768 |

| 3-5 Days Of Hospitalization | $1,560-$3,120 | $1,560-$3,120 | $2,080-$3,640 |

| Treating / Repairing A Wound (Cuts, bites, scratches) | $832-$1,560 | $832-$2,080 | $1,040-$2,600 |

| Pet Surgery (accident, swallowed something, break) | $1,560-$3,120 | $1,872-$3,120 | $2,080-$5,200 |

| Oxygen (pet asthma, heart failure, breathing issues) | $520-$2,600 | $832-$2,600 | $1,040-$3,120 |

| Ultrasound (for diagnosing issues) | $312-$624 | $312-$624 | $312-$624 |

It’s important to note that the table above may not be what you pay for services in your area of Virginia. These prices are averages based on the type of treatment being offered across the whole US with state cost of living adjustments. Also, there are often other costs that may be necessary like medications (pain meds can easily run another $40-$80), appointments, vet office fees, additional lab fees.

As you can see the costs can quickly add up to be thousands of dollars. It’s also important to consider that things can quickly stack on top of each other.

For example: If your dog broke a leg that requires surgery, the surgery bill alone may be $3,000 but it also requires a few days in the hospital to monitor the pet which now adds another $2,000. This is not to mention the likely X-rays and diagnostic work ups.

Does My Vet Take Pet Insurance?

How do you know if your veterinarian in Virginia accepts pet insurance or the pet insurance you end up choosing? We know this is an important question because for so many people a great vet who gets to know both you and your pet is like a family member.

All Vets & Animal Hospitals In VA “Accept” Pet Insurance

The good news for Virginia residents however is that you don’t need to worry about whether your vet accepts pet insurance – because pet insurance companies reimburse you directly instead of paying the vet. So your pet insurance is going to make sure you are covered at any vet.

How Does Pet Insurance Work In VA?

Unlike your human health insurance that you may be familiar with that has networks and approved providers, pet insurance in Virginia is much simpler because your pet insurance company will reimburse you directly and let you use the vet of your choice. So this means no hoops to jump through about finding specific vets covered by specific insurance companies. Keep the vet your dog or cat loves!

What’s the Pet Insurance Process Like?

- Research and purchase your pet coverage policy.

- Get your pet treated at the Virginia vet of your choosing.

- Pay your vet yourself via cash, check, credit card & keep all the bills and receipts.

- Submit a claim to your pet insurance provider.

- Get reimbursed (usually in about a week) based on your plan’s policy, terms and specifics.

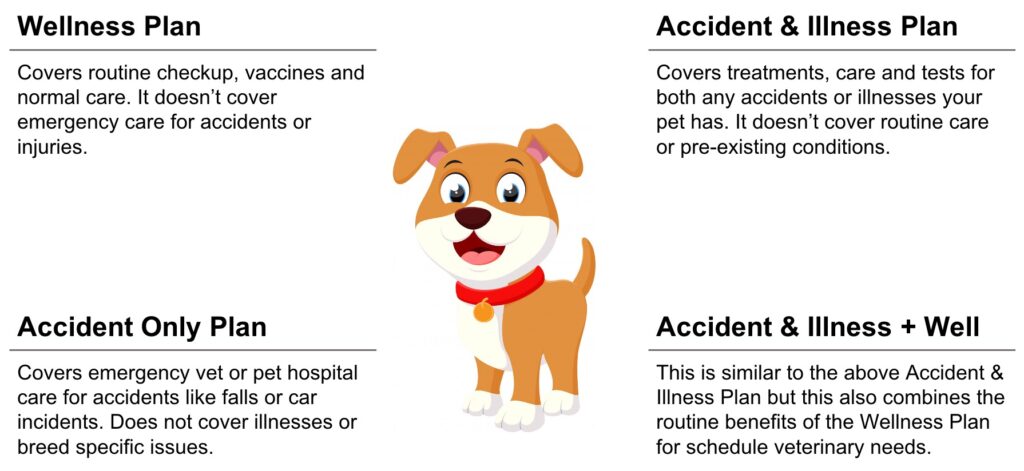

What Are The Types Of Insurance Plans?

| Pet Insurance Plan Type | It Covers | Doesn’t Cover | Average Annual Cost / Premium |

|---|---|---|---|

| Pet Wellness Plan | Routine checkups, vaccines, normal care | Accidents & Injuries | |

| Pet Accident Only Insurance | Emergency vet care for accidents | Illnesses, pet specific breed issues, pre-existing conditions, | $190 (Dogs) / $141(Cats) |

| Pet Accident-Illness Insurance | Treatments & tests for both accidents & illnesses | Routine care, pre-existing conditions | $566 (Dogs) / $354 (Cats) |

| Pet Accident-illness + Wellness (Most comprehensive option) | All expected or unexpected treatments | Pre-existing pet conditions |

Details Of The Insurance Plan Types In Virginia

It’s important to understand the difference between these plans and maybe most specifically what is considered a “pet accident” vs. a “pet illness” because it can make a big difference on whether you are covered or not.

What’s A Pet Accident?

It’s considered an “Accident” when your dog or cat is physically injured due to a mishap. For pets these are often related to things like being hit by a car, falling off a balcony, or a fight with other animals. Things that typically occur and need vet treatment from an accident include (but are not always limited to):

- Broken bones

- Burns

- Cuts

- Other physical injuries

A pet accident plan will cover the vet bill reimbursement in Virginia (excluding any deductibles or extra copays) for the emergency vet or hospital care for your dog or cat’s accidents. Please make sure to note pet accident insurance coverage does NOT cover illnesses or breed-specific issues.

What’s A Pet Illness?

Pet illnesses are issues your pet has that are not related to a specific incident or accident. Some common items include:

- Viral infections

- Parasites

- Hip dysplasia (check your plan)

- Cancer

What’s A Pet Wellness Plan?

A wellness plan for your dog or cat offers reimbursement for the regular pet preventative care that you regularly plan on needing for your pet. This are the expected items like your pet vaccines and regular checkups.

It’s important to note however that these costs for your pet are fairly predictable and easy to plan for because they happen regularly and are more predicable in cost. Most people don’t purchase a “just wellness” pet plan. More frequently this is a smaller add on to an accident or accident-illness pet coverage plan.

What’s The Most Popular Type Of Pet Insurance Plan?

If you live in VA and are trying to decide which of the above options are the best choice for your dog or cat, we recommend getting personalized quotes and looking at which options meet your budget and coverage needs.

In the United States, most people choose the Accident & Illness coverage plans because it gives them the most comprehensive protection for their pet and their finances. In fact, 98% of pet insurance plans are accident-insurance combination plans.

Virginia Pet Insurance Plan Details & Options

How Much Are Insurance Deductibles In Virginia?

Whether you are getting your plan in Virginia in the South or East towards Columbus or Bloomington or closer to Terre Haute or South Bend in this Mid Western State or anywhere else in the country, your deductible is actually not related to your region. The deductible for your insurance plan is going to be based on the specific plan you choose.

In general, you can choose a Higher Deductible plan and that will mean your monthly or annual premiums will be lower. On the other side, if you want to be protected against having to pay a higher deductible amount out of pocket during an emergency you can opt for a lower deductible plan and choose to pay higher premiums.

As with human health insurance, pet insurance deductibles can feel complicated at times, because they are! If you’d like to get all the details, check out our pet insurance deductible FAQ guide.

The Most Common Annual Deductible Amounts In Virginia Are

- $100

- $250

- $500

Why Choose A Higher Deductible Plan?

When it comes to pet insurance deductibles in Virginia, you may wonder why you would ever want a $500 deductible vs. a $100 or $250 deductible? Isn’t paying less out of pocket for emergency pet hospital or vet costs a no brainer?

The answer isn’t quite that simple because deductibles are a tradeoff between premiums. In order to have a lower deductible for that emergency coverage you will have a higher monthly or annual insurance premium. So how do you choose which is better?

It comes down to your financial situation. Would you prefer to pay a little more in premium each month or year in a very predictable amount to save that extra money on the deductible IF something does happen?

Or would you like to keep your monthly pet premiums lower each month, but know you will have to front a little more cash towards your deductible IF something does happen that requires you to request insurance reimbursement.

What Is The Virginia Reimbursement Percentage For Dog Or Cat Insurance?

The reimbursement percentage on your pet policy is based on your specific policy and provider and not related to where you are located. Typical reimbursement percentages usually range from about 70% to 90%.

Insurance For Pets With Pre-Existing Conditions In Virginia

Wondering, can I get pet insurance coverage for my pet if they have a pre-existing condition and we live in VA?

Every pet insurance company has their own specific list of health conditions that they exclude from their coverage plans so it’s best to check with each company and get an pet insurance coverage estimate for your specific case.

Most pet insurance companies will consider the follow list of conditions pre-existing and thus excluded from coverage:

- Cancer

- Diabetes

- Allergies

- Arthritis

- Heart disease

- Urinary blockages

- Pet Epilepsy

What Can I Do If My Pet Has A Pre-Existing Condition

The good news is that even if your dog or cat does have a pre existing health issue and won’t get coverage from standard pet insurance in Virginia, you have other options.

You can check in Veterinary Discount Plans that offer discounts on all of your vet visits even if your pet has a pre-existing condition. They are not pet insurance, so luckily they will still work with you even if your pet already has diagnosed cancer, diabetes etc.

The great news is that they will also offer you discounts on your regular vet visits for shots, exams, and dental care as well as more complicated items like:

- Sick visits

- Emergency care and hospitalization

- Surgical procedures

- Spays and neuters

- Routine care and vaccines

- Dental exams, cleanings, and x-rays

- Allergy treatments

- Diabetes management

- Cancer care

The other benefits of getting a vet discount plan just beyond the fact that they cover everything is that you don’t have to wait for reimbursement or calculate various coverage options.